There are several good reasons why a micro finance institution needs an information system. Primarily, such a system will solve the following problemsErrors in entries

- Difficult reporting

- Fraud

- Loss of data

- Lack of efficiency

Any information system for managing loans has to address the following issues:

- Multiple users using the system concurrently

- Multiple branch offices

- Easy management and backup

- Ease of usage

- Different types/groups of clients

- Means of customizing to meet any additional need of the micro finance institution

- Multi-users

- Multi-currency

- Multi-branch/Multi-level of consolidation

- Centralized Mode(requiring reliable network)

- Decentralized Mode(when network is unreliable or not existent)

Â

Features

Clients

- Individuals, solidarity groups, corporate entities

- Customizable fields

- Pictures

- Duplicate client checking

- Client watch list

- Client blacklist

- Client History

- Multi-criteria search engine for clients

Amortization (Repayment) Schedules

- Preset types of schedules (constant payment, constant principal)

- Fully customizable schedule ("exotic products")

- Grace periods on principal / interest payment

- Schedules skip holidays (customizable)

- Schedules skip week days (customizable)

- User-selected payment frequency (daily, weekly, monthly, 28-days, etc.)

- User-rounded total payment

- Rescheduling module (supporting multiple reschedules)

- Management of Prepayments (automatic reschedule can be disabled)

- Flat / declining interest rates

- Variable annual basis for interest accrual

- Daily accrual / cash method

- Upfront / standard interest payment

Fees and Penalties

- Disbursement fee-origination fees

- Penalties on principal payment

- Penalties on interest payment

- Penalties on overdue principal

- Penalties on overdue interests

- Anticipated repayment fee

- Quick access to loans in arrears in the "Alert window"

- Due payments are prompted

- Overdue payments are prompted

- Detailed report on loans and clients in arrears

- Reports on Portfolio At Risk, with customizable breakdown

Other Loan Features

- Loan cycles managed at the product level

- Credit committee

- Tracking approved, rejected, suspended and abandoned applications

- Multi-criteria search engine of contracts

Collaterals & guarantors

- Customizable categories of collaterals

- Editable contract for collateral

- Tracking of guarantors

- Editable contract for guarantors

- Time weighed method of interests calculations

- Minimum weekly/monthly balance

- Various interests payment frequency (daily, weekly, monthly, yearly)

- Resource Management (funding lines)

- Donors and creditors tracked

- Grants and credits tracked

- Resource balance controlled before disbursement

Reporting & Analyses

- Default reports for detailed analysis of clients, applications, loans and collaterals

- Default "consolidation reports" for management

- Exportation to MS Word, Excel or PDF.

- Customization or addition of new reports through Crystal Report

Accounting module

- Customizable according to local schemes

- Manages Cash/Accrual methodology

- Loan loss reserve matrix

- End-of-period closure showing the loan degradation and write-off

- Exportable to an external accounting application

- User password encryption

- Different user level rights and restrictions

- Event log and audit trail

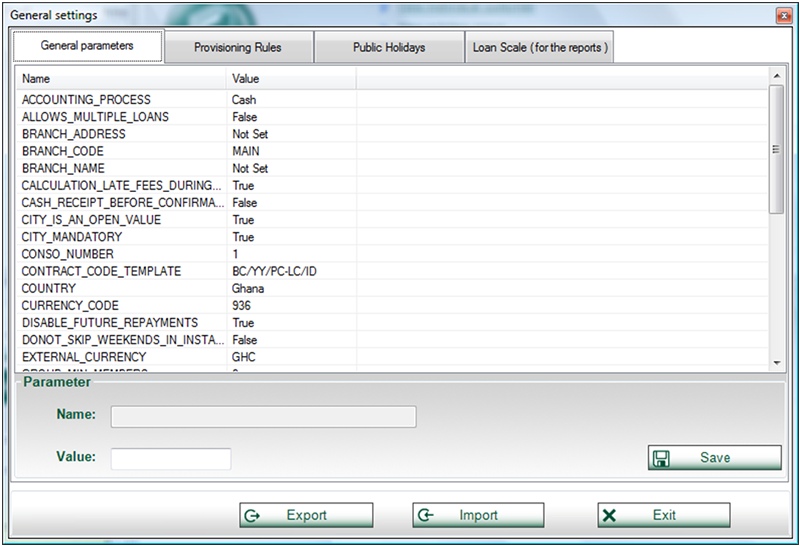

Screenshots

Technical Specifications and Requirements

- Pre-requisites: Framework .NET 3.5

- Database: SQL Server Express (free) or SQL Server 2005

- Reports: Crystal Report XI

Minimal hardware requirements for the client part are:Â

- Pentium II or higher,

- 64 MB RAM,

- 20 MB free disk space

Â

Â

Contact us to learn more about our company, services and capabilities.

To start a dialogue with our consulting representative, please complete the following

Request Information form, and one of our representatives shall contact you shortly.

Â

Â